how to lower property taxes in texas

So if your property is assessed at 300000 and. There are generally two ways that Texas homeowners can reduce their property taxes through tax exemptions or protesting their propertys assessed value.

Texas Property Tax Trends Informal Hearing Reduction

One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available.

. These bills will provide over 600 million in relief per biennium to homeowners. Faced with that experts say achieving a decrease may be more difficult this year but. 7 Steps to Appealand Win By Stephanie Booth.

Qualifications and application procedures vary by. Check for property tax relief. Want to Lower Your Property Taxes.

If you get a reduction but not under the cap you owe us nothing. That could potentially save you hundreds of dollars annually. Take a look at the full list of exemptions available to Texans online at the Texas Comptroller of Public Accounts page.

Your tax rates for school taxes MO are going down because we passed HB 3. Your local administration maintains a property tax card for every residential and commercial property in the. Three factors determine the Texas property tax bill for a property.

Property Tax Calculation The three factors are used by the county appraisal district to calculate the property tax. The tax rate that is applied to the taxable value. The Definitive Guide for Lowering your Property Tax Bill.

And the other and most common is to take advantage of the property tax exemptions available to Texas residents. Taxes arent rising as. Tax Code Section 2518 states that all appraisal districts must complete appraisals on every property in.

A lower tax obligation. If voters approve the. This will help seniors receive the same benefit State Sen.

Multiply that number by your districts tax rate and you have your property taxes. Take a look at the full list of exemptions available to Texans online at the Texas Comptroller of Public Accounts page. Values that help determine property tax bills later this year are up 20 to 30 across the region over 2021.

Homeowners have two ways they can reduce the amount of taxes they have to pay. If We Cant Lower Your Property Taxes You Owe Us Nothing. This money is used in paying for and providing important services to Texas residents such as schools.

Most Common Property Tax Exemptions. How to lower your property taxes April 19 2022 435 PM Most North Texans have about a month now to decide if they want to push back against the sharpest one-year rise in property values appraisers say theyve ever seen. For reference weve linked a few popular local.

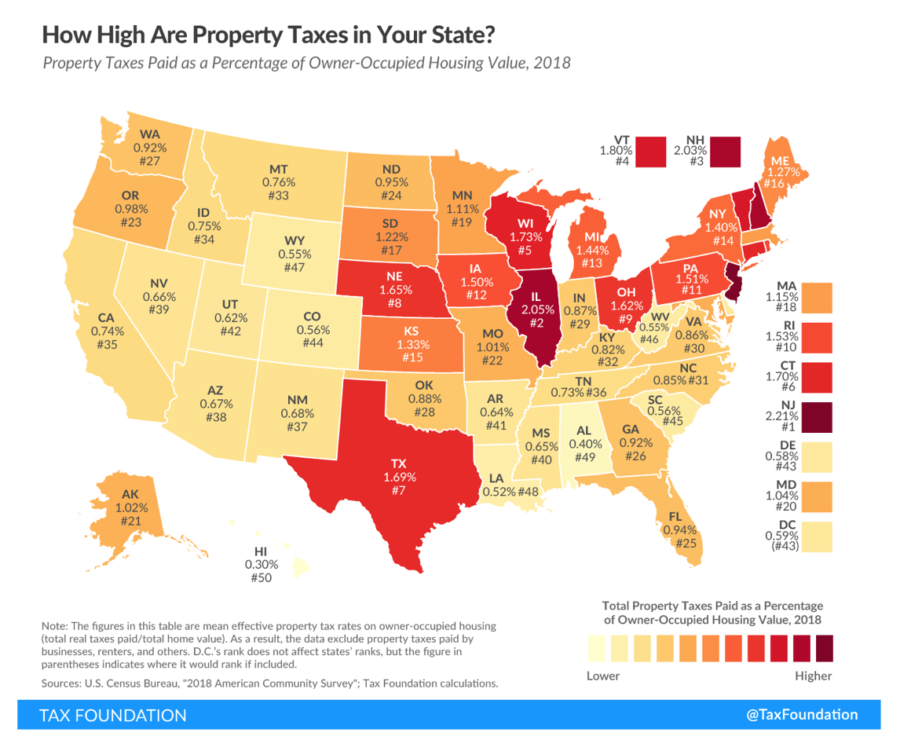

A property tax exemption may reduce the taxable value of the property. Due to the absence of state income taxes and a substandard sales tax of approximately 825 most of the revenue earned by the state has to be generated through property taxes. In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value.

Property tax relief has been one of my top priorities since I was elected to the Texas Senate in 2014. Texas voters will decide whether to lower their property tax payments after Legislature completes last-minute Hail Mary. If your home is valued at 75000 for example but you have a 10000 exemption you are only taxed on the new value 65000 75k 10k exemption.

Lower property taxes in texas with a property tax exemption the most reliable method of lowering taxes is by qualifying for a property tax exemption. The Travis Central Appraisal District or TCAD is doing what it can to educate homeowners. Most taxing districts evaluate property values every two years and in down markets rarely lower the property values without a protest from the homeowner.

Look up the protest process with your district. And if you live in a high-tax stateNew Jersey Illinois and Texas. One is they can contest the propertys appraised value put forth by the appraisal districts appraiser.

Under the standard Texas homestead exemption you would be allowed to reduce the taxable value of your property by 25000. The first proposition would draw down property taxes for elderly and disabled Texans by reducing the amount they pay to public schools which typically makes up most of a homeowners tax bill. In many states in the US counties collect property taxes to cover a variety of social systems including public transportation fire departments law enforcement education and public spaces.

First a homestead exemption in Texas removes part of your homes value from taxation so they lower your. Check your property tax card for errors. Compare neighboring property.

The assessed value of the property. So you would only be paying taxes on a 175000 property value versus 200000. There is no fee unless you save actual tax dollars.

Definitive Guide to Lower Your Property Taxes in Texas. Tax Code Section 1113b requires school districts to provide a 25000 exemption on a residence homestead and Tax Code Section 1113n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value. How homestead exemption works in texas.

Rising Property that Makes Lower Property Taxes in Texas Harder.

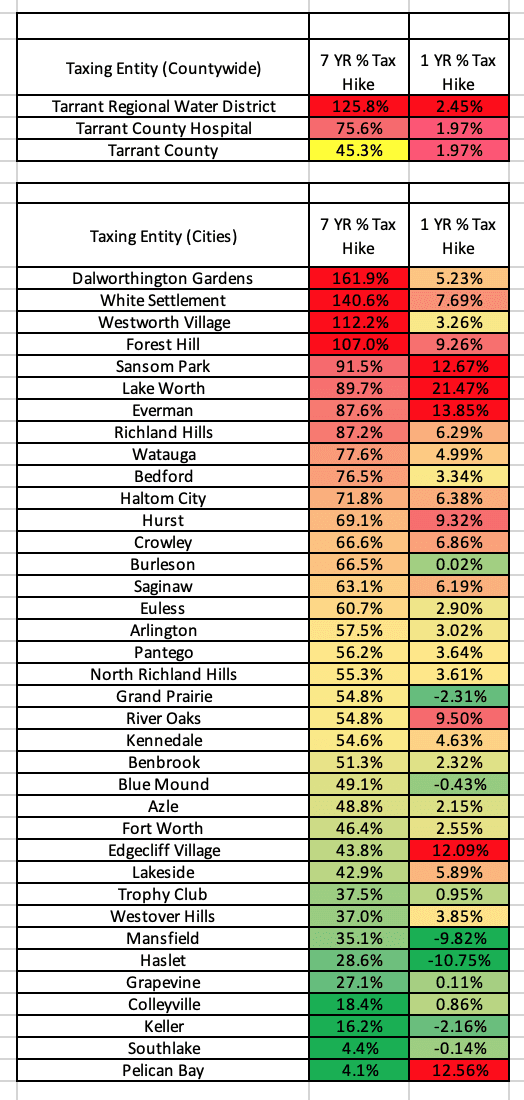

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

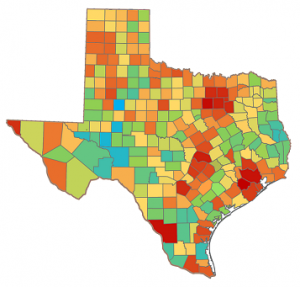

Tac School Property Taxes By County

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Analysis Texas Government S Favorite Local Tax

Tac School Property Taxes By County

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Tac School Property Taxes By County

Over 65 Property Tax Exemption In Texas

/static.texastribune.org/media/files/7eaf54967fd9e1e99018c3430a2e7340/Aerial%20Suburbs%20JV%20TT%2002.jpg)

Texas Legislature Sends Property Tax Constitutional Amendment To Voters The Texas Tribune

Texas Voters Will Decide Whether To Lower Some Property Tax Bills In May Election

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

/https://static.texastribune.org/media/files/4cb5621a1321941aca5f8d0b30d6a83b/share-art.png)

How Do Texas Governments Calculate Your Property Taxes Here S A Primer The Texas Tribune